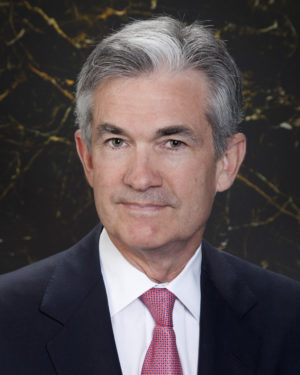

Federal Reserve Chairwomen Janet Yellen will be ending her term in February of 2018, and she should be handing the gavel over to our new chairman, Jerome Powell, who was nominated by president Trump.

Bond and stock markets welcomed the nomination as Powell is seen as having a very similar leadership style to Yellen, who was dovish, meaning that they are less inclined to raise rates. Powell had been on the Federal Reserve’s board of governors since 2012 and studied at Georgetown Law and Princeton.

Raising rates faster than the markets would prefer could jeopardize our economy’s health and could also put the equity markets in sell mode.

Mortgage rates have been steady this month, with the 30-year just below 4 percent and the 15-year hovering around 3.375 percent. This could change very quickly if the new tax cuts come into effect.

At the time of this writing, the House or Representatives easily passed their version of the tax cut bill proposed by the White House, but the Senate had not yet voted, because there was concern that there were not enough votes to get it passed.

What does this have to do with mortgage rates? A LOT! Should an aggressive tax bill pass, the markets could view that as adding more debt to the already debt-stricken government, which would have upward pressure on rates.

The tax cuts could also put more pressure on inflation, which has remained tame for quite some time. Raising rates would be the most effective way to keep inflation in check should we see that go up after the tax cuts.

Others argue that without these tax cuts our economy will begin to slow and could put us into another recession. The equity markets have also seen record-high stock prices, all of which are banking on these tax cuts.

The economists at Fannie Mae and Freddie Mac are estimating that rates will rise by approximately .5 percent in 2018 and then by more than 5 percenrt in 2019.

If you are looking to buy or refinance, doing this sooner rather than later could prove to save you thousands over the life of the loan.

To contact me, call 773-557-1000 ext. 15, e-mail ron@ronmortgage.com or visit http://www.ronmortgage.com.

Fra Noi Embrace Your Inner Italian

Fra Noi Embrace Your Inner Italian